Bajaj Electricals: a good long-term bet

2 min readImproving prospects in EPC, consumer durables segments bode well for firm.

Investors with a long term perspective can consider buying the stock of Bajaj Electricals – a large player in the consumer durables market with a presence in the engineering, procurement and construction (EPC) business as well.

At the current market price of Rs. 294 the stock discounts its estimated earnings for FY16 23 times, making it cheaper than its peers Havells and V-Guard Industries.

Though Bajaj Electricals put up a poor show in FY15 with just 6 per cent revenue growth and a net loss of Rs.1,395 crore, it holds promise for 2015-16 and beyond.

One, the EPC segment, which was a major drag on profitability, is set to turn around. Secondly, the consumer durables business, which contributes 40 per cent of the revenue, could record improved revenue and margins with the streamlining of its supply chain.

Theory of constraints

In the consumer durables business, Bajaj Electricals expects sales and RoI to improve with the adoption of the ‘theory of constraints’ approach.

As the theory advocates removing constraints that impair the business, Bajaj Electricals is focusing on improving returns for channel partners by helping them maintain a low inventory.

In the March quarter, the consumer durables business grew 2.5 per cent, but margins almost doubled to 6.8 per cent on a better product mix and lower dealer discounts.

The EPC business, which accounts for 30 per cent of revenue, returned to profitability in the March quarter, recording a 4.7 per cent margin.

The company has cleared all legacy orders where there was a cost over-run. The EPC order book now stands at Rs.3,400 crore, executable over the next one-two years with most orders giving the firm a 5-6 per cent margin.

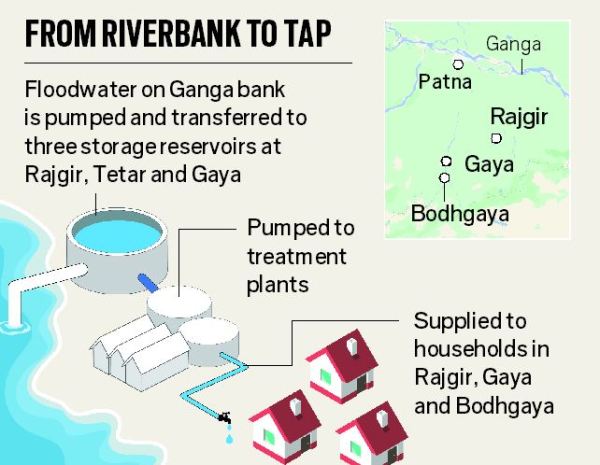

In February, Bajaj Electricals won an order from North Bihar Power Distribution Company for erection of transmission towers worth Rs.566 crore.

The company’s improved capabilities in execution should hold it in good stead when competing for government projects.

The lighting segment, which has been going through tough times due to the demand shift to LED from CFL, should revive with the company’s aggressive marketing efforts to gain a greater share in LED bulbs.

As LEDs give a better margin than CFLs, the lighting segment’s margins should improve with the company’s expanded presence in LEDs.

Courtesy: The Hindu – Business Line