Local bodies must yield more tax: Subramanian

3 min read Patna: Arvind Subramanian, chief economic advisor to the Narendra Modi government, isn’t terribly pleased about the tepid effort that states are making to crank up tax revenues from their urban and rural local bodies.

Patna: Arvind Subramanian, chief economic advisor to the Narendra Modi government, isn’t terribly pleased about the tepid effort that states are making to crank up tax revenues from their urban and rural local bodies.

“I worry a lot about the low level fiscal effort. Revenue generated from local urban and rural bodies is flat, contributing only about 4.5 per cent of the states’ total revenues,” Subramanian said while delivering a lecture titled “An Analytical Framework for Fiscal Federalism in India” organised by the Centre for Economic and Public Finance, Asian Development Research Institute (ADRI).

Urban local bodies usually collect tax in the form of property tax, vacant land tax, tax on shops and establishments, profession tax, and tax on outdoor advertising which they usually retain to meet their own expenditure.

They also collect entertainment tax and stamp duty surcharge which are in the nature of assigned revenues – which means they are transferred to the state exchequer.

A principal source of revenue for urban municipalities used to be levied in the form of octroi and entry tax on vehicles entering municipal jurisdictions which have since been subsumed under the goods and service tax.

Subramanian suggested that the main reason for the poor fiscal effort by local bodies was the reluctance of governments to raise taxes that could ignite popular resentment. “There is another option: increase services so that people are willing to pay taxes,” he added.

The chief advisor lauded implementation of GST as a revolutionary model of politics, administration and technology which would benefit states like Bihar. He said that ever since the 14th Finance Commission submitted its report, there had been three major changes: the Planning Commission had been abolished, the 14th Finance Commission had raised the states’ share in central taxes from 32 to 42 per cent, and GST had been implemented.

On fiscal federalism, Subramanian highlighted the three Rs – redistribution, risk sharing and reward – that determine its functioning. He also said that the finance commission should set aside some money for shocks likes floods or droughts.

Subramanian suggested that incentives be given to local bodies and panchayats for better performance, and this could be given as matching grant from the Centre. For Bihar, Subramanian suggested it should keep up its 10 per cent GSDP growth for the next 25 years.

In his introductory speech, deputy chief minister Sushil Kumar Modi said regional disparity in the states was gradually increasing.

He cited that there had been an increase in states’ share from 28.5 per cent in the 11th Finance Commission to 42 per cent in the 14th Finance Commission, but Bihar’s share in the divisible pool was gradually decreasing from 14.6 per cent to 9.66 per cent in the same timeframe.

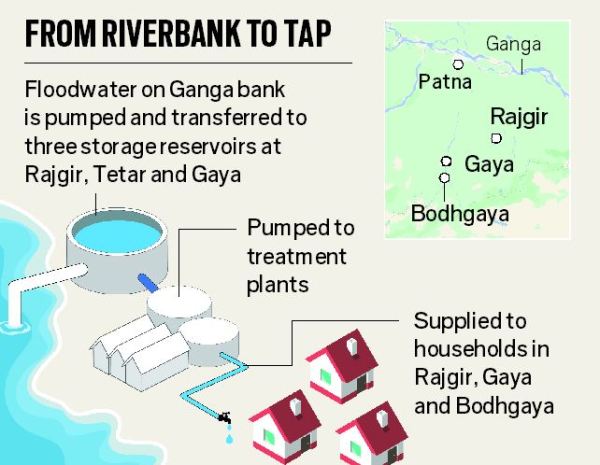

Modi said that Bihar suffers from vagaries of flood every two years but has got only Rs 2,591 crore in assistance compared to Maharashtra (Rs 8,095 crore) and Madhya Pradesh (Rs 4,848 crore).

Shaibal Gupta, member-secretary, ADRI, said in his welcome remarks that the Constitution does provide a mechanism to address the issue of fiscal federalism, but does not provide a theoretical framework for the challenging exercise.

Gupta said it is the unwritten responsibility of scholars like Subramanian to suggest such a framework.

Courtesy: The Telegraph