Sushil calls for focus on social welfare

3 min read Patna: Deputy chief minister Sushil Kumar Modi on Saturday asked banks operating in the state to perk up their act with regard to RTGS (real time gross settlement) of DBT (direct benefit transfer) related to social welfare and security schemes.

Patna: Deputy chief minister Sushil Kumar Modi on Saturday asked banks operating in the state to perk up their act with regard to RTGS (real time gross settlement) of DBT (direct benefit transfer) related to social welfare and security schemes.

“DBT with regard to social security schemes were made to over 57 lakh accounts through banks during 2017-18. However, 1.73 lakh of these transactions failed, while in 1 lakh transactions we could not get to know why money was not transferred,” Sushil said.

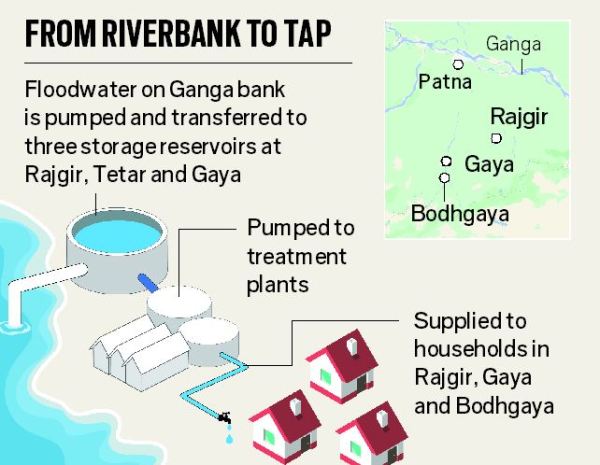

Sushil, who also happens to be the finance minister, pointed that during the floods last year, DBT could not be done into the accounts of a large number of beneficiaries. He was speaking at the 64th quarterly state level bankers’ committee (SLBC) meeting held here.

“There have been incidents when money for DBT in social welfare schemes remain with the banks for several months. All these need to be improved. Banks have a big role to play in the development of the state,” he added.

Sushil also revealed the state government was considering direct transfer of scholarships into the accounts of beneficiary students and for this accounts will need to be opened.

Reviewing the working of various public and private sector banks in the state at the meeting which saw the presence of senior administrative officials, bankers and RBI regional director N.P. Topno, Sushil said the banks achieved 90.85 per cent of the annual credit plan (ACP) for the state during financial year 2017-18 by giving loans worth Rs 99,934 crore against a target of Rs 1.10 lakh crore.

The ACP lending was 87.91 per cent of the target in2016-17. For the current financial year 2018-19, ACP target has been fixed at Rs 1.3 lakh crore.

“I have told the banks that ACP target achievement percentage could be improved further as there are districts like Madhepura and Supaul where achievement was just 61 per cent and 68 per cent of the target, respectively. Similarly, ACP achievements have been less than 80 per cent in Sitamarhi, Banka, Darbhanga and Madhepura,” Sushil said.

The deputy chief minister added that he had requested the banks to pay special attention to the districts where ACP achievement has been less than 80 per cent.

He also expressed worry over low achievement of ACP targets with regard to agriculture in several districts like Madhubani, Madhepura, Darbhanga and Supaul.

“We have asked the banks to do branch-wise review to rectify the situation. We have also asked them to find out the reasons behind low credit deposit ratio in several districts and submit a report. I will myself tour these eight or nine districts and attend meetings on it,” Sushil added.

The banks have shown a strong performance in providing credit to self-help groups. They provided Rs 2,364 crore credit to 1.96 lakh SHGs in 2017-18 against a target of 2 lakh SHGs.

The recovery of loans from SHGs stood at 96 per cent, which showed that the poor were prompt in paying back the money they took from banks.

Sushil said altogether Rs 10,559 crore was deposited in total 3.03 crore Jan Dhan accounts in Bihar. The state saw opening of 63.26 lakh new Jan Dhan accounts in 2017-18.

Courtesy: The Telegrpah