DeMo ghost returns to haunt

3 min read Patna: Demonetisation may be dead and buried but the cash-crunch ghost has returned to haunt the city with most ATMs dry. And it is not a one-day aberration. It has been happening for the last two-three days. Downed shutters, “no cash” and “out of service” signs have become common sights at the ATMs.

Patna: Demonetisation may be dead and buried but the cash-crunch ghost has returned to haunt the city with most ATMs dry. And it is not a one-day aberration. It has been happening for the last two-three days. Downed shutters, “no cash” and “out of service” signs have become common sights at the ATMs.

Almost all the ATMs at the Rajendra Nagar roundabout, of HDFC, Corporation Bank, State Bank of India (SBI), and Bank of Baroda, were without cash on Wednesday afternoon.

The scenario was the same at the Malahi Pakdi area that has a cluster of ATMs. The SBI, ICICI and Corporation Bank ATMs there were not dispensing any cash, and neither were the two nearby ATMs of SBI at the Chitraguptanagar area in Kankerbagh. The SBI ATM at Chitraguptanagar has been sporting the “no cash” sign for the last three days.

On Fraser Road in the heart of the city the ICICI, Syndicate Bank, and Central Bank of India ATMs were without cash. Anil Kumar Pandey, a senior citizen, was scouting on Wednesday for an ATM dispensing cash. “I need money urgently as my relative is under treatment at the nearby Heart Hospital,” said Pandey, who was seen at the HDFC ATM near Rajendra Nagar roundabout.

A young man, Rakesh Kumar, quipped: ” Lagta hai notebandi fir se aa gaya. (It seems the note ban has returned).”

The bankers admit there is a cash crunch, but the situation is such that almost no one is willing to speak on record.

“Though the banks are receiving cash, the despatches are not sufficient to meet the demand. The cash being received from the Reserve Bank of India (RBI) does not even meet one-fourth of our requirement; it is 1/6th or 1/8th at present,” a top SBI official said under cover of anonymity. the official said. “This is the reason we could not replenish our ATMs.”

SBI has more than 400 ATMs in Patna but almost all of them are running dry, the official admitted.

“The people are dependent on cash. Even if any ATM is replenished, it goes dry in an hour or two,” the SBI official added.

Asked when the condition is expected to improve, the official said: “I cannot say when the situation will ease out. We are totally dependent on the RBI. As soon as RBI provides us cash, we will meet the demands.”

Repeated efforts to contact RBI Bihar-Jharkhand regional director Nelan Prakash Topno went in vain. His personal assistant said Topno was busy.

J.P. Sinha, chief manager, Bank of Baroda, claimed that the bank’s 48 ATMs in the city are being replenished at regular intervals. However, when it was pointed out that the kiosks at the bank’s ATM at Kankerbagh are without any cash, Sinha had no answer. Another bank official said: “The situation has come to this pass as apart from the RBI not meeting our requirement, the deposits by customers have dropped drastically and withdrawals from fixed deposits and other deposits have increased like never before. This is attributed to the confusion created among the people as a result of the financial resolution and deposit insurance bill.”

The bill has brought in a concept coined by the European banking crisis of 2008-09, called “bail-in”, where a bank’s depositors are forced to bear some of the burden of recapitalising the lender by having a portion of their deposits written off.

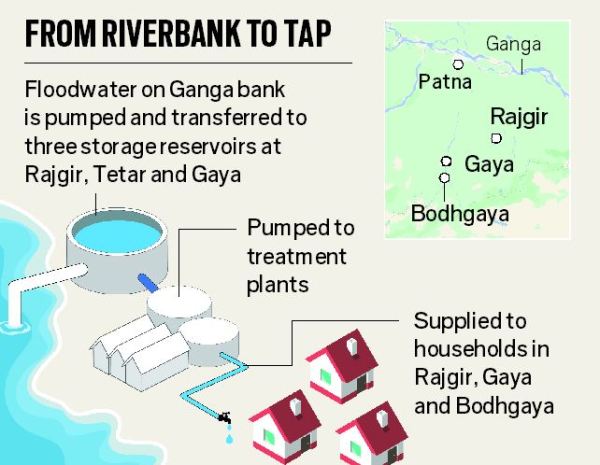

The Telegraph had reported in its April 9 edition how at least three districts, Gaya, Darbhanga and Bhagalpur, are reeling from cash crunch.

Courtesy: The Telegraph